|

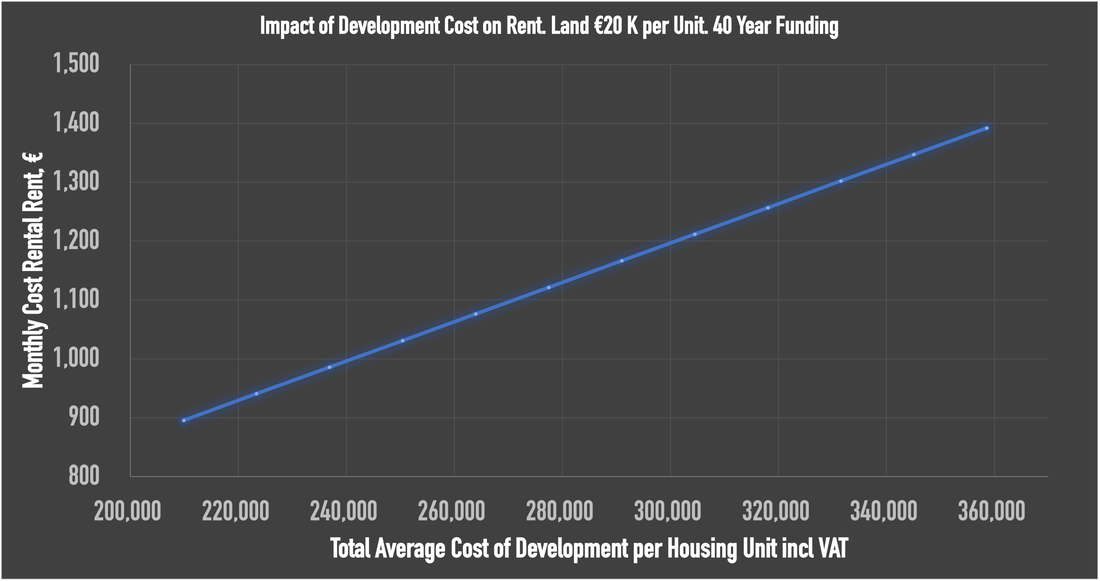

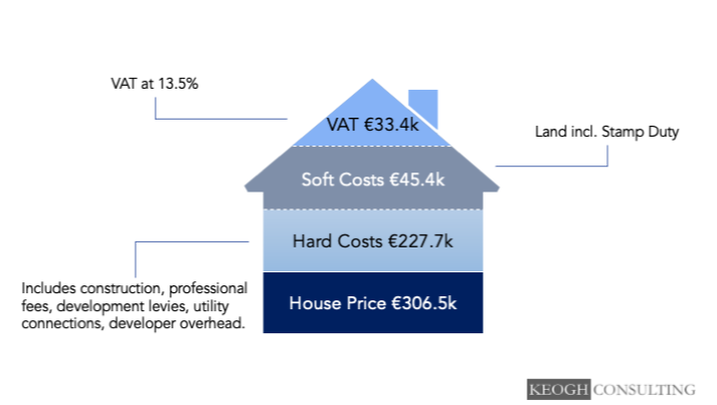

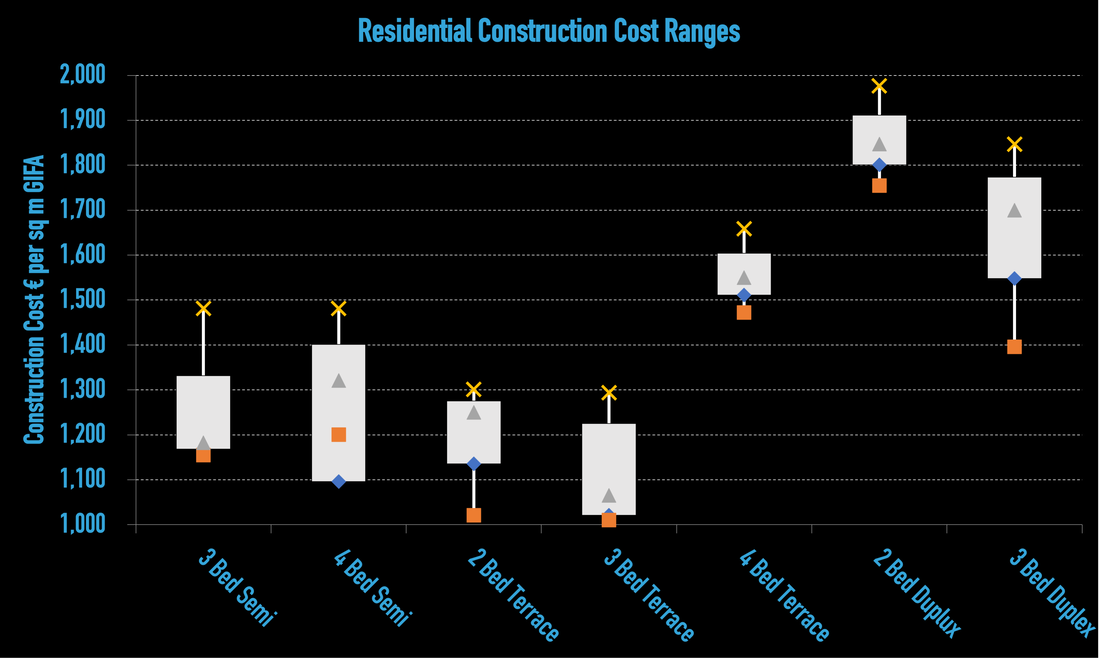

With the LDA seeking applications for over 600 cost rental apartment in January there has again been much discussion on the level at which the rent is set. The target for the rents was set at least 25% below market rates in the area. It is called cost rental because the rent is used to cover the cost of constructing the accommodation over the life of a long-term building. It has proven to be a very effective way of providing housing in many European countries and is a part of the LDA’s housing delivery mechanism. Through the Project Tosaigh initiative the LDA are currently trying to unlock stalled developments and kickstart construction through partnering with developers and make homes available as either cost rental or for purchase through a shared equity scheme. While there has been recent discussion about cost rental these is less visibility on how rents are set, however, in a January Oireachtas housing committee meeting[1] there was some interaction among the witnesses and committee members on how the rent level was set and why the rent was at the level it was. The high level and unaffordability of the proposed cost rental rents (>30% household disposable income) was highlighted by some of the attendees. [1]https://www.oireachtas.ie/en/debates/debate/joint_committee_on_housing_local_government_and_heritage/2024-01-23/3/accessed on 1/2/2024 There are difficulties in achieving rents below €1,000 per month given the costs associated with residential projects and the level of subsidy required to drive down the rent level under this delivery mechanism. Using the LDA Barnwell Point development in Hansfield Dublin 15 as an example this article and the attached financial model looks to illustrate how the rent is calculated based on assumptions made from publicly available sources. The subsidy or grant required to bring the monthly rent below €1,000 is also calculated. LDA Cost Hansfield Cost Rental Scheme Having obtained planning in 2018 and being completed in late 2023 the Barnwell Point development (part of the wider Hansfield SDZ) by McGarrell Reilly involves 247 apartments over 6 blocks on a 1.5 Ha site with 272 carpark spaces. The works include the construction of 70 No. Studio & 1 bed apartments; 164 No. 2 bed apartments; 12 No. 2 bed duplex units; and 1 No. 3 apartments. With my estimate of total construction costs for the 21,447 sq m GIFA scheme at €66.8M the total development cost is €85.2M inclusive of VAT and land. A net household income of up to €66,000 makes you eligible for the scheme. The rent is linked to the cost of the build, and will remain stable despite any market increase. Tenants will pay €1,400 per month to live in the 2-bedroom Cost Rental homes delivered as part of this project[1]. The rent of €1,400 per month, based on the cost of delivering and maintaining the homes, is a significant reduction when compared to market rents for 2-bedroom apartments in this location (<25%) The projects have been delivered through the LDA’s Project Tosaigh initiative. The completed development will be manged by a named management agent (not the LDA).  LDA Development Overview LDA Development Overview Cost Drivers The following are the costs that have to be covered when setting the cost rental rent level:

Residual Value at End of Analysis Period The apartments are owned at the end of the assumed 40 year period and thus they have a residual value beyond the analysis period - this can be based on the market value at that time (using an appropriate terminal cap rate) or the rebuilding cost at that time (using an appropriate average construction inflation estimate). Discount Rate The projects discount rate is the rate of return used to discount future cashflows back to their present value (PV). This rate is often an organisation’s weighted average cost of capital, required rate of return, or the hurdle rate expected relative to the risk of an investment. In Ireland the NDFA publishes recommended project specific discount rates. An approximation can be made by using a long term building loan. The model (bit.ly/KeoghCostRental) calculates the present value of each individual cash flow (rental income or expense) as a growing annuity – a series of future periodic payments that grow at a proportionate rate. Final year values and costs are calculated by inflating incomes and costs using the assumed growth rates – these values and costs are then discounted to the present value using the discount rate. [1] The average rent across the development is calculated to be €1,347 p.c.m. with a total estimated gross income of €123,456 p.a.

0 Comments

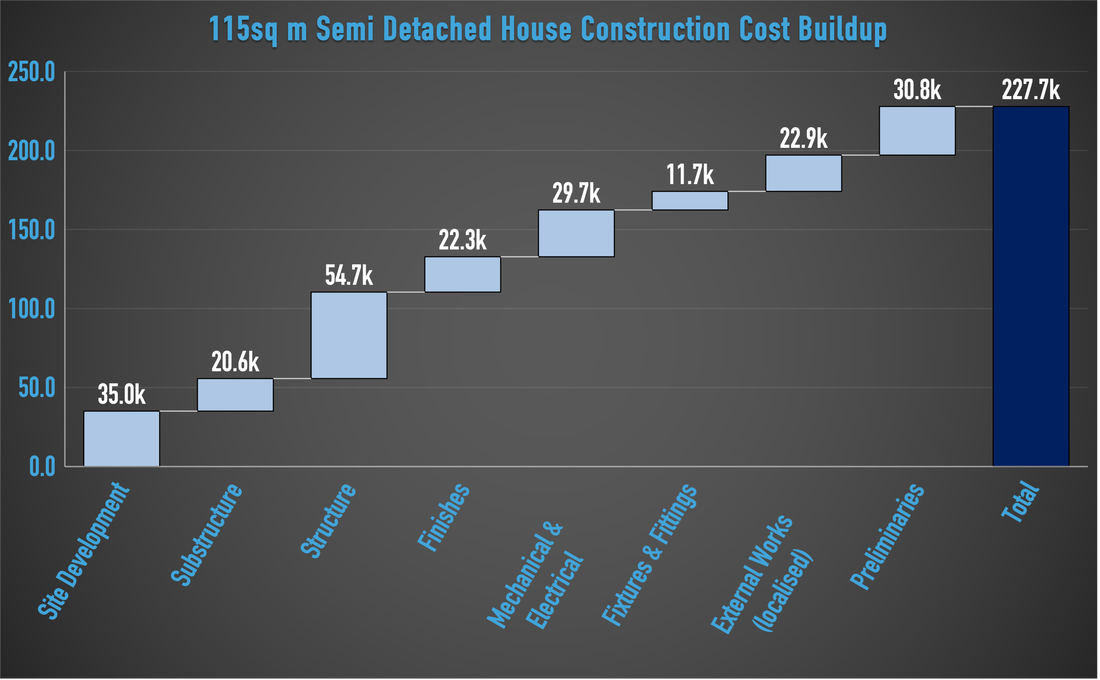

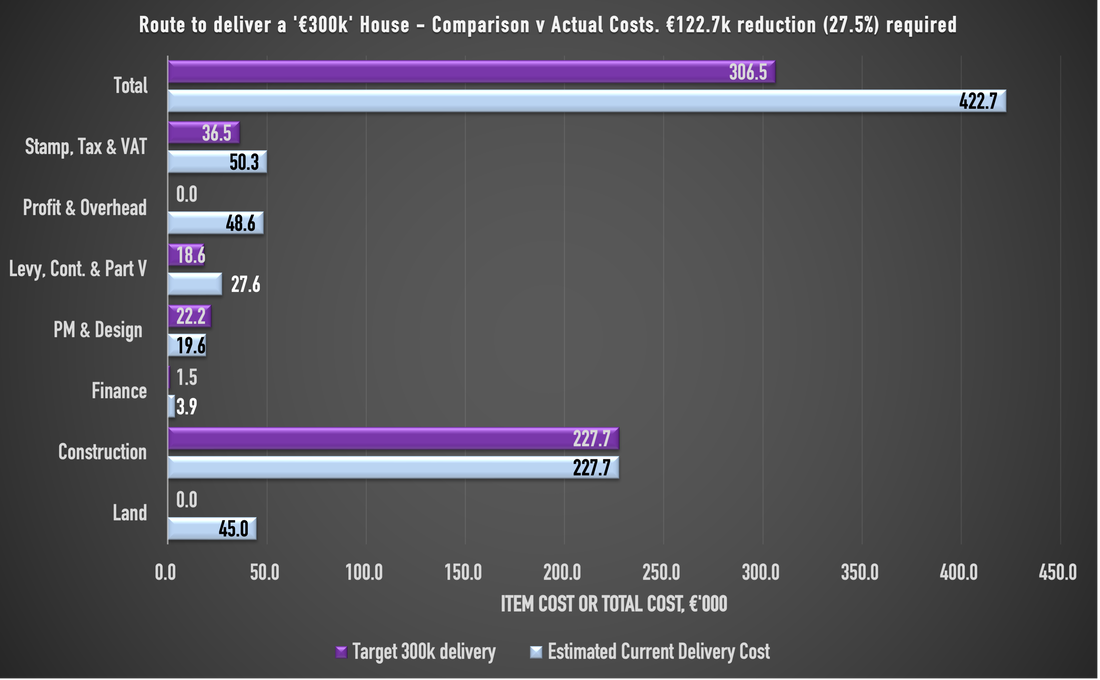

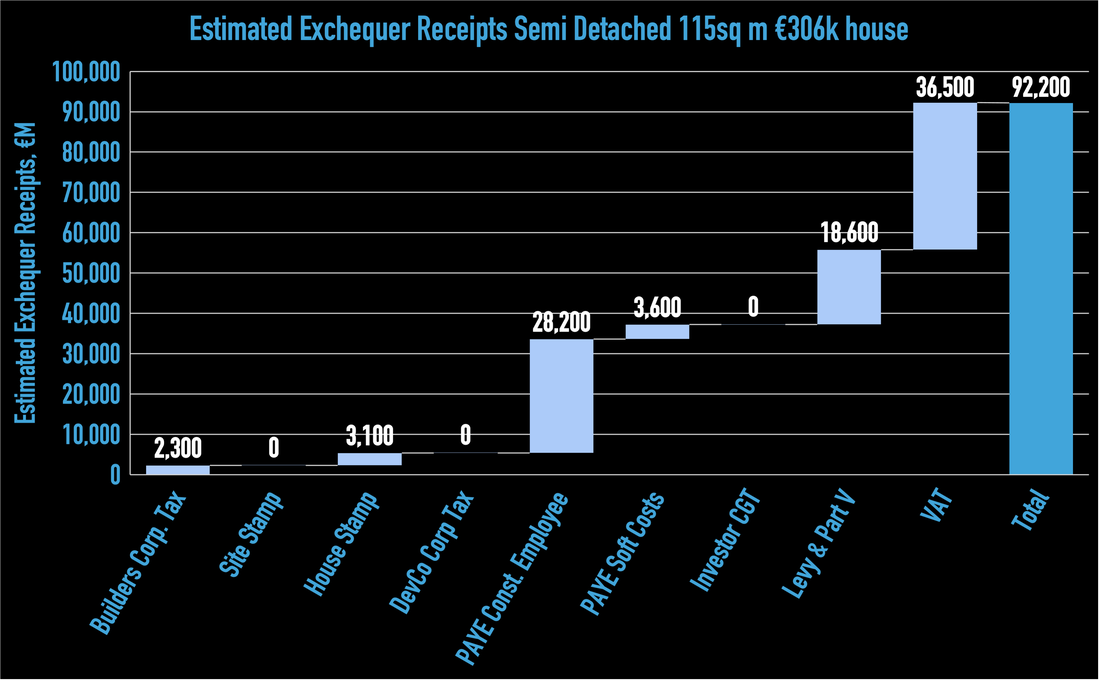

I've previously written about what would have been required to deliver a house for €250k - seems an age ago when we didn't know about this thing called Covid (https://bit.ly/250kHouse). Housing delivery at €300k is now spoken about as a target (115sq m semi detached house). In summary - it is quite hard to do so - especially with this target assuming no profit/contingency. Off site construction may be part of the solution to lowering costs, however, the real advantages of OSM may not kick in until high volume is achieved given the large fixed cost base of off site construction companies - requiring high utilisation to achieve low costs. It’s a bit of a chicken and egg situation given the large investment in OSM factories required in advance of demand appearing in a market. The LDA are being tasked with delivering homes of state owned lands. Given the governance requirements around being careful with the public purse it is apparent now that this approach is a slow and risk minimising approach. The LDA recent report on relevant public land identified sites for 67,000 affordable homes on 83 state owned sites. The published average estimated development costs are generally above €300k - it is not an easily reached target even for the public sector with a not for profit mandate. However, given the government take from incremental house building being high there may be positive cost benefit ratios - not though without significant distortion to the market that may have state aid and competition impacts. One thing that is given minimal consideration is the fact that these analyses typically consider development on a standalone site - not the reality of development of multiple small, medium and large sites in parallel with differing risk profiles.

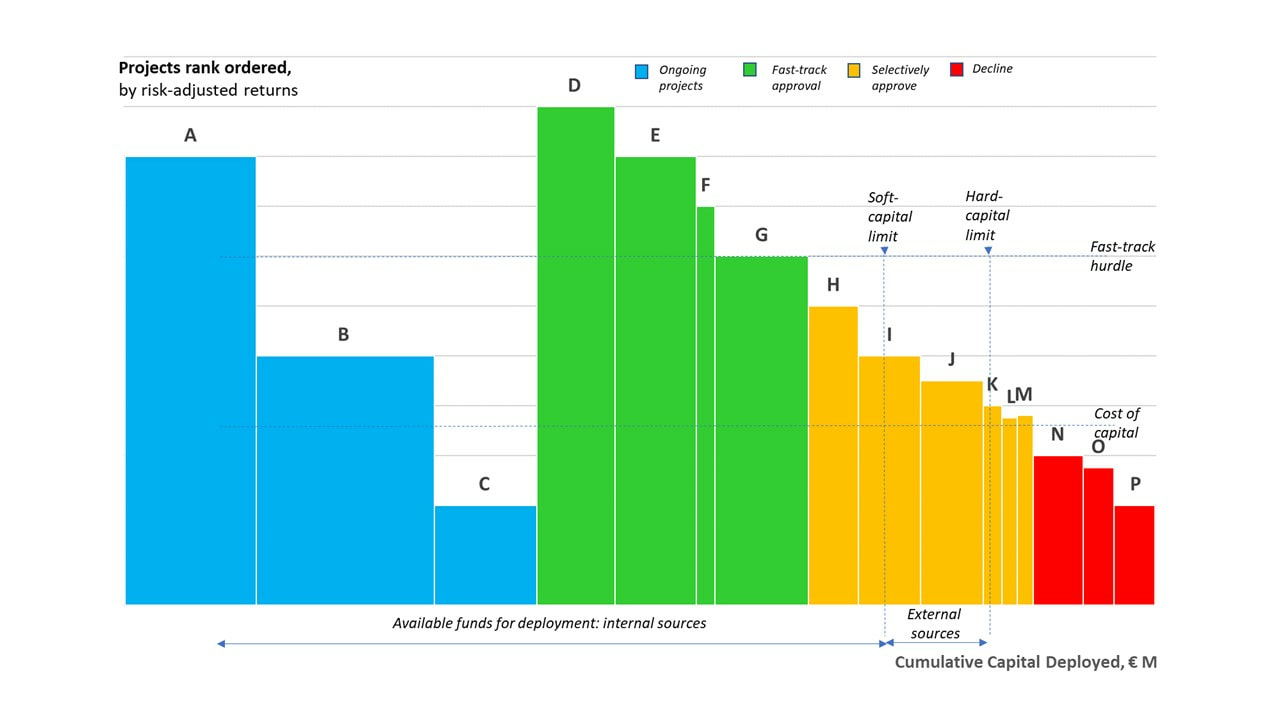

Decision makers need to have a range of tools and methodologies available to decide which projects to prioritise, particularly when making strategic investment decisions on multibillion-euro capital projects and programmes.

Recently in Ireland there has been much discussion on capital budgeting, cost benefit analysis, the risks inherent in long term projects and how best to put a plan in place to identify and manage these risks. When significant cost increases occur in projects with a knock-on impact of curtailing funding for other approved projects, or during an annual capital budgeting process with differing project classes competing for scarce capital, you need to be able to prioritise projects. This paper illustrates an approach to prioritisation. With high stakes and sometimes political pressure, elaborate financial and economic models are prepared to justify potential projects. But when it comes down to the final decision, especially when hard choices need to be made among multiple opportunities, less rigorous assessment means are dusted down - arbitrarily discounting estimates of expected returns or economic benefit, for example, or applying overly broad risk premiums. There are more transparent ways to bring assessments of risk into investment decisions. In particular, some analytical tools commonly employed in capital-intensive industries can be applied, such as those investing in projects with long lead times or those investing in shorter-term projects that depend on the economic cycle. The result can be a more informed, data-driven discussion on a range of possible outcomes. Of course, even these tools are subject to assumptions that can be speculative. But the insights they provide can still produce a more structured approach to making decisions and a better dialogue about trade-offs. A simple residential real estate investment project is presented as a case study of using the approach which could be used for example by a development company when deciding how best to allocate investment over a portfolio of residential, commercial, retail and industrial project opportunities. The real power of using these tools comes from using them systematically, however, leading to better decisions from a more informed starting point: a standard model for projects; a fact-based depiction of how much an organisation’s current performance is at risk; a consistent assessment of each project’s risks and returns; how those projects compare; and how current and potential projects can be best combined into a single portfolio. Should you wish you find out more about this methodology or how Keogh Consulting can assist in assessment of your project portfolio please contact us at info@keoconsult.com With news that proposals are going to Cabinet in the coming weeks to mandate builders to provide 10% of new developments to local authorities as social homes, and a further 10% as affordable housing the impact will be to increase price of homes for private purchasers (as required return on a project would then have to be achieved from selling a smaller number of units for sale to private purchasers). The scale of impact will vary but for a typical standard 2 bed apartment in an SHD type development this could add €9.5k (+2%) to the required sale price (with the average cost for a LA to purchase a 2-bed unit in such a development being €360.4k). For a 3-bed house the required price will increase from €338k to €346k (+2.5%).

The Keogh Consulting Construction Cost iOS App (bit.ly/KeoghCosts) has been updated to Q1 2021. The database provides an overview of construction and development cost, rental rates and exit yield ranges for a number of common property types. Developed from market forecasts, research into recent transactions and detailed analysis of quoted Irish real estate companies and REITs, it provides a range to determine a starting point for a valuation based on user defined inputs. Due to current market conditions valuations can be discounted to account for uncertainty in the calculator.

Construction cost and tender indices have been updated to reflect current market sentiment and expected labour, material costs and target margin in 2021. The information in the iOS App is provided for general guidance and is intended to offer the user general information and is not provided to replace or serve as substitute for any valuation, budgeting, cost planning, financial advisory, tax or other professional advice, consultation or service. |

About Us

Keogh Consulting looks to help individuals and organisations deliver the right projects the right way. Here is some of our knowledge and a few case studies that we hope will help you on your project journey. Categories

All

Project Cost Calculator & DatabaseCost Rental Simple ModelCost Rental Complex Model |

Service |

Company

|

|

RSS Feed

RSS Feed