|

With many employees currently working remotely from home, and with some projects paused, it could be time for many small businesses to look at a number of areas that usually are long term projects but can easily be run remotely. One such area is your website. Whether a light wipe or a deep clean a periodic review of your website should be part of scheduled activities in your firm. This checklist gives an step by step approach to a review of your website. Hope it is helpful. keo_consult_website_review_checklist.pdf Our previous article about developing a social media approach may also prove useful at this time www.keoconsult.com/knowledge/developing-and-delivering-a-social-media-strategy-for-professional-services-firms

0 Comments

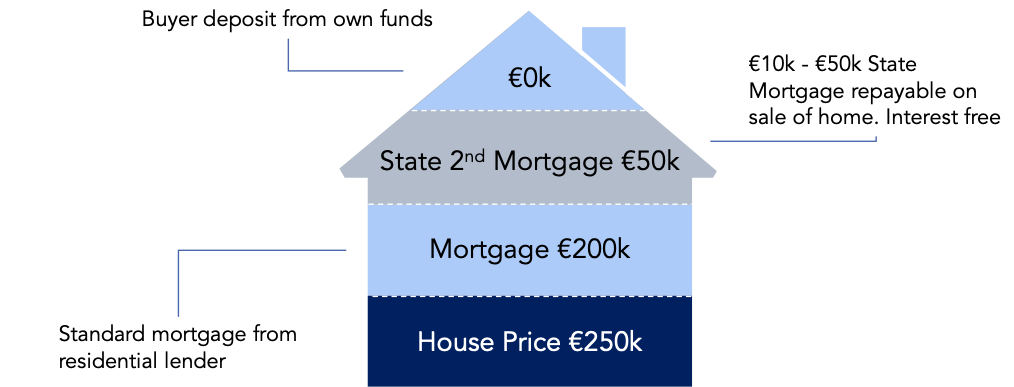

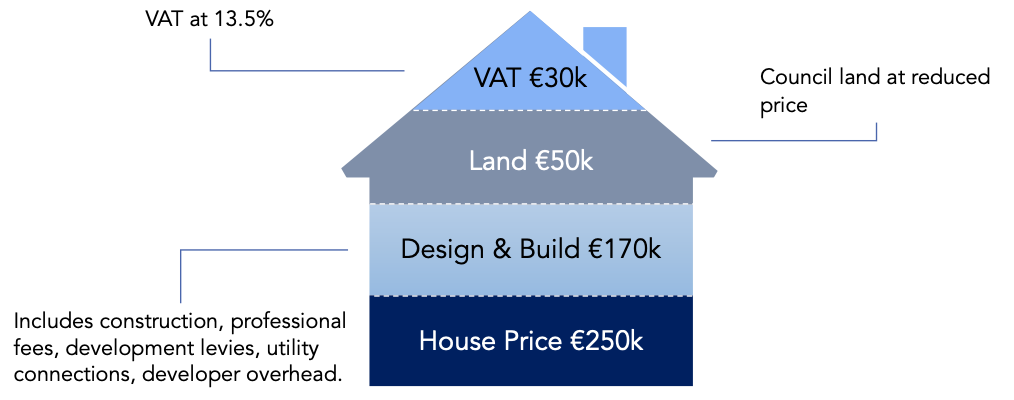

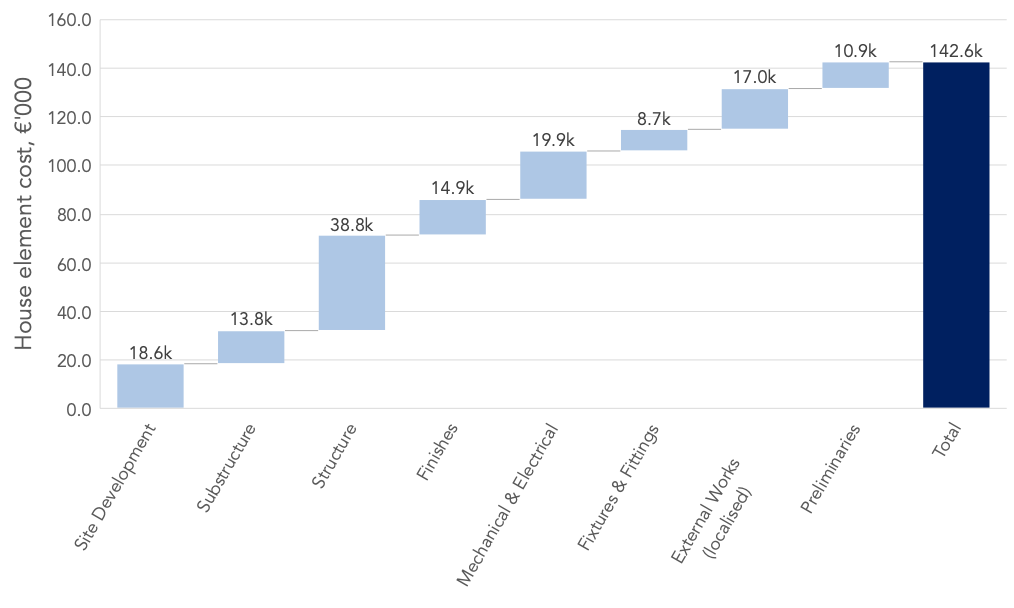

In a March opinion piece in the Irish Times Dermot Desmond set a stretch target of €250k for the Property Industry in Ireland to deliver an affordable home. The homes would be constructed on State owned lands with a payment of €50k being made to the land owner. This implied the high level cost breakdown in Figure 1. Mr Desmond then proposed, to assist affordability, that the state would provide a second interest free mortgage of between €10k and €50k per household depending on their income and occupation. The second mortgage would be repayable on the sale of the house. The funding approach is illustrated in Figure 2.  Figure 2 - Funding Approach Figure 2 - Funding Approach Estimates from benchmarked construction projects indicate that the buildup of the base construction cost of a 1,000 sf ft house would be as indicated in Figure 3 - 1,000 sq ft House Construction Cost Buildup. Analysis shows that with free land a reduced size affordable house of 1,000 sq ft could be developed for sale at €210k. (€266.8k incl. land). This assumes that serviced land is available at zero cost on which to build these homes. Including the land cost the outturn cost is €16.8k over the €250k target that had been set. From experience it it probable that site development costs would be higher than the noted €18.6k on account of the unserviced nature of such sites and the requirement to bring services to the sites - this would increase the excess over the target further. At a sale price of €267k, a proposed government interest free mortgage of €50k could be added to personal funds of €217k to buy such a house. This could be raised by a standard mortgage with a gross household income of €61.9k given the Central Bank LYI multiplier of 3.5x. Government receipts are still significant at this sale price (estimated at €66.9k). Given the market failure to service this sector of the housing market these are houses that otherwise would not be constructed (on account of viability issues) and thus, the additionality may be near to 100% with increased government receipts being able to cover the cost of funding a €50k interest free loan.

Conclusion Delivering a house at a price target of €250k is risky and challenging and involves a number of assumptions around procurement costs and overheads being equivalent to the private sector, the specification (smaller) of the home and the cost of site development. Further reductions could be achieved through reducing development contributions payable to local authorities. There are a number of community schemes in the market built on a not for profit basis on public land that appear to achieve this cost target, however, significant subsidy has been given to facilitate construction at this price point. The exchequer receipts generated by constructing such houses are significant and could possible go towards funding of a scheme (using a government loan) given the likelihood of such homes not being provided on a for profit basis given private sector viability issues at this price level. Full report can be downloaded here Ongoing affordability issues in the housing market are resulting in increasing numbers renting. This situation is exerting upward pressure on rents and now creating rental affordability issues. This raises the questions is it more affordable to buy than rent and what is an affordable rent for households? This study updates our previous study of Q3 2019.

According to the Residential Tenancies Board “the year-on-year growth rate of the national standardised average rent increased to 8.2 per cent in Q3 2019. The quarter-on-quarter growth of rent prices increased to 3.3 per cent in Q3 2019, indicating a further strengthening in the quarterly inflation. It is likely that affordability issues in the housing market are resulting in an increasing number of people moving into the rental sector, exerting upward pressure on rents.“ A significant increase in the number of properties available for both sale and rent will be required in order to temper the rapid growth in rent prices.” Given this continued increase in rental costs, the current slowdown in the rate of housing price increase raises the attractiveness of ownership over rental – “For the first time since late 2012, the national average listed price fell for two consecutive quarters – with a 2.4% fall in Q4 following a 1.7% fall in Q3” . Determining is it really cheaper to buy than rent is important when looking to create solutions to address current housing provision issues, and, for developers when determining the target market and price level for their housing product? This paper calculates estimated median household income levels in each county in Ireland and determines the proportion of household income available for housing costs. This proportion of household income available towards housing costs is then compared to average rents in each county to determine the affordability of renting in that county. This analysis highlights that:

From the CSO property price register (and in particular first-time buyer house price data) the cost of a 30-year mortgage to buy a median FTB home is calculated for each county. This cost is then compared with average rental cost in that County. This element of our analysis highlights that:

The issues around housing provision and housing affordability are complex and affect every family but none more so that the vulnerable people in our society – a functioning rental market needs to be in place with a range of options provided by state and private sector available for families. Options that need to be considered include a structured cost rental model using low cost loans, increased rent supplements and housing assistance payment rates in line with market rent. At the same time a balance needs to be made between the Central Bank’s safeguarding of financial stability and the ability of households to get loans costing less than current rental cost to purchase affordable homes. Download our full article here |

About Us

Keogh Consulting looks to help individuals and organisations deliver the right projects the right way. Here is some of our knowledge and a few case studies that we hope will help you on your project journey. Categories

All

Project Cost Calculator & DatabaseCost Rental Simple ModelCost Rental Complex Model |

Service |

Company

|

|

RSS Feed

RSS Feed