|

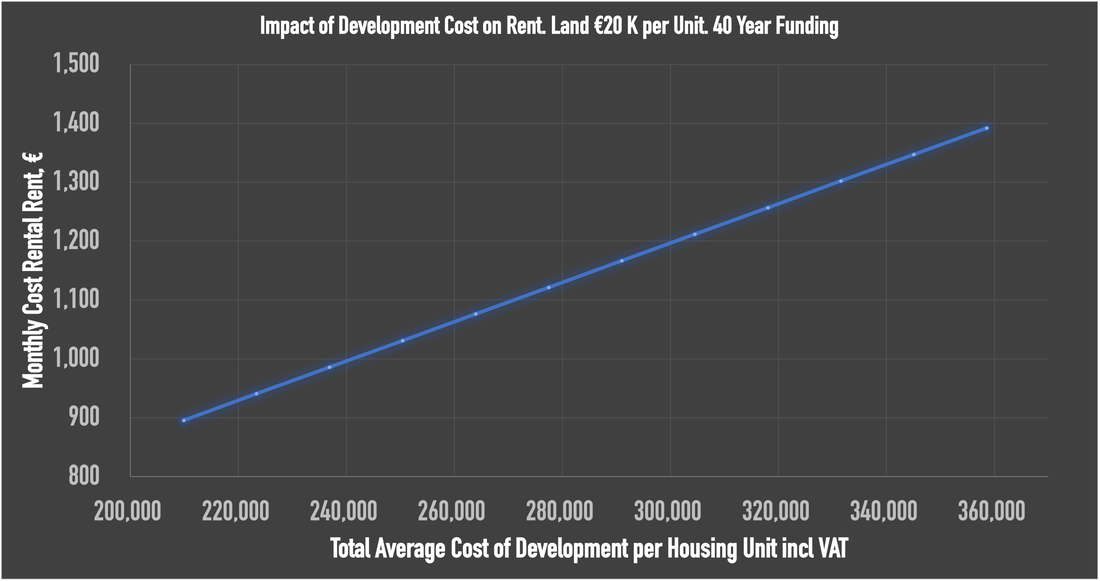

With the LDA seeking applications for over 600 cost rental apartment in January there has again been much discussion on the level at which the rent is set. The target for the rents was set at least 25% below market rates in the area. It is called cost rental because the rent is used to cover the cost of constructing the accommodation over the life of a long-term building. It has proven to be a very effective way of providing housing in many European countries and is a part of the LDA’s housing delivery mechanism. Through the Project Tosaigh initiative the LDA are currently trying to unlock stalled developments and kickstart construction through partnering with developers and make homes available as either cost rental or for purchase through a shared equity scheme. While there has been recent discussion about cost rental these is less visibility on how rents are set, however, in a January Oireachtas housing committee meeting[1] there was some interaction among the witnesses and committee members on how the rent level was set and why the rent was at the level it was. The high level and unaffordability of the proposed cost rental rents (>30% household disposable income) was highlighted by some of the attendees. [1]https://www.oireachtas.ie/en/debates/debate/joint_committee_on_housing_local_government_and_heritage/2024-01-23/3/accessed on 1/2/2024 There are difficulties in achieving rents below €1,000 per month given the costs associated with residential projects and the level of subsidy required to drive down the rent level under this delivery mechanism. Using the LDA Barnwell Point development in Hansfield Dublin 15 as an example this article and the attached financial model looks to illustrate how the rent is calculated based on assumptions made from publicly available sources. The subsidy or grant required to bring the monthly rent below €1,000 is also calculated. LDA Cost Hansfield Cost Rental Scheme Having obtained planning in 2018 and being completed in late 2023 the Barnwell Point development (part of the wider Hansfield SDZ) by McGarrell Reilly involves 247 apartments over 6 blocks on a 1.5 Ha site with 272 carpark spaces. The works include the construction of 70 No. Studio & 1 bed apartments; 164 No. 2 bed apartments; 12 No. 2 bed duplex units; and 1 No. 3 apartments. With my estimate of total construction costs for the 21,447 sq m GIFA scheme at €66.8M the total development cost is €85.2M inclusive of VAT and land. A net household income of up to €66,000 makes you eligible for the scheme. The rent is linked to the cost of the build, and will remain stable despite any market increase. Tenants will pay €1,400 per month to live in the 2-bedroom Cost Rental homes delivered as part of this project[1]. The rent of €1,400 per month, based on the cost of delivering and maintaining the homes, is a significant reduction when compared to market rents for 2-bedroom apartments in this location (<25%) The projects have been delivered through the LDA’s Project Tosaigh initiative. The completed development will be manged by a named management agent (not the LDA).  LDA Development Overview LDA Development Overview Cost Drivers The following are the costs that have to be covered when setting the cost rental rent level:

Residual Value at End of Analysis Period The apartments are owned at the end of the assumed 40 year period and thus they have a residual value beyond the analysis period - this can be based on the market value at that time (using an appropriate terminal cap rate) or the rebuilding cost at that time (using an appropriate average construction inflation estimate). Discount Rate The projects discount rate is the rate of return used to discount future cashflows back to their present value (PV). This rate is often an organisation’s weighted average cost of capital, required rate of return, or the hurdle rate expected relative to the risk of an investment. In Ireland the NDFA publishes recommended project specific discount rates. An approximation can be made by using a long term building loan. The model (bit.ly/KeoghCostRental) calculates the present value of each individual cash flow (rental income or expense) as a growing annuity – a series of future periodic payments that grow at a proportionate rate. Final year values and costs are calculated by inflating incomes and costs using the assumed growth rates – these values and costs are then discounted to the present value using the discount rate. [1] The average rent across the development is calculated to be €1,347 p.c.m. with a total estimated gross income of €123,456 p.a.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

About Us

Keogh Consulting looks to help individuals and organisations deliver the right projects the right way. Here is some of our knowledge and a few case studies that we hope will help you on your project journey. Categories

All

Project Cost Calculator & DatabaseCost Rental Simple ModelCost Rental Complex Model |

Service |

Company

|

|

RSS Feed

RSS Feed